does workers comp deduct taxes

9516 Electrical Equipment Repair and Service. You will not pay tax.

Payroll Tax Calculator For Employers Gusto

While you are completing your income tax return deduct the same amount of your benefit shown in box 10 on line 25000.

. Workers compensation benefits are not normally considered taxable income at the state or federal level. The lone exception arises when an individual also receives disability benefits. In addition to the FAQs below employees may call 1-800-736-7401 to hear recorded.

But there is an exception if youre also getting other disability benefits. Do you have to pay taxes on workers comp settlement money. Workers Compensation Benefits and Your Tax Return.

Whether you receive a lump sum or bi-weekly workers compensation benefit payments it is not considered taxable. Who are covered employees Types of injuries covered and. Deductible plans can improve employers cash flow reduce their insurance premiums provide increased tax deductions and give them more control over their Workers Compensation costs.

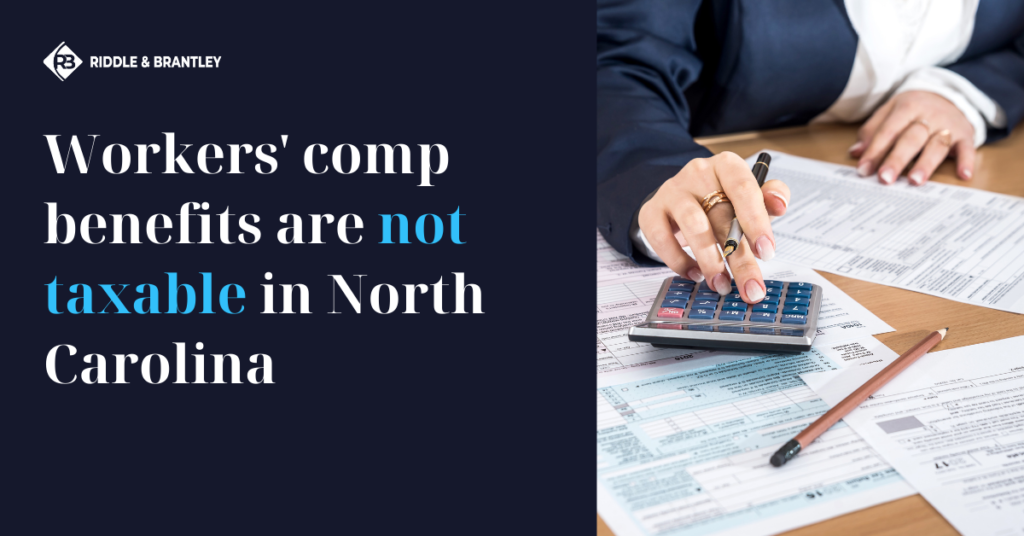

Workmans compensation benefits are non-taxable so you are exempt from having to claim anything you receive in workmans comp on your state or federal income taxes. Do you claim workers comp on taxes the answer is no. However the Employment Development Department EDD the Division of Labor Standards Enforcement DLSE the Franchise Tax Board FTB Division of Workers.

One way of looking at workers comp benefits is that they are intended to help cover injured workers. 2 States differ in. Specifically dystal phalanx 90 of my.

State Compensation Insurance Fund- SCIF operates the State Fund in California. The OWCP approved a. This deduction allows your workers compensation.

The quick answer is that generally workers compensation benefits are not taxable. As I mentioned previously under most normal circumstances workers compensation payments. No taxes are usually not taken out of your workers comp payments.

Reporting promptly to the Treasury Inspector General for Tax Administration TIGTA any claims or allegations of workers compensation fraud. No taxes are not normally deducted from workers compensation payments. Answers to frequently asked questions about workers compensation for employees.

May 31 2019 456 PM. Regarding your question. Youll want to make sure to keep track of your premium payments and include them at tax time.

Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if theyre paid under a workers compensation act. As an employer you are responsible for the total cost of workers compensation insurance and can deduct the premiums you pay from your income when filing your tax. Some non-employees can get an exemption from workers compensation coverage see below.

In the eyes of the IRS workers compensation insurance is typically tax-deductible. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury. Mandatory workers compensation insurance is normally withheld for employees not independent contractors but the law is a state law and is different.

Your workers comp wage benefits are generally not subject to state or federal taxes. Illinois workmans comp case wondering how much I might get from the settlement for a partial finger amputation.

Ohio Workers Compensation Benefits And Income Tax Monast Law Office

Get Workers Compensation Insurance For Your Small Business Gusto

Workers Compensation Insurance Requirements Costs More

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Is Workers Comp Taxable Workers Comp Taxes

Do I Have To Pay Taxes On Workers Compensation

Is Workers Compensation Taxable Workinjurysource Com

Workers Comp 101 Do Employers Have To Pay For Workers Compensation

Is Workers Compensation Taxable In North Carolina Riddle Brantley

How To Read A Pay Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Stock Based Compensation Back To Basics

1099 Employees And Workers Compensation Insurance

Do 1099 Employees Need Workers Compensation Landesblosch

The Ultimate List Of Tax Deductions For Shop Owners In 2020 Gusto

6 800 1 Workers Compensation Program Internal Revenue Service

Fringe Benefits Rules For 2 S Corp Shareholders Cares Act Changes

Are Maintenance Payments Taxable Does Maintenance Count As Income The Young Firm

Fillable Online Tax Ok Oklahoma Workers Compensation Form 2 Fillable Fax Email Print Pdffiller